Top 7 Chart Patterns in Trading Every Trader Needs to Know

In this article, I am going to discuss the Top 7 Chart Patterns in Trading That Every Trader Needs to Know. Please read our previous article, where we discussed Supply and Demand Trading.

What are Chart Patterns?

Chart patterns are the basis of price action analysis and technical analysis and require a trader to know exactly what they are looking at in chart pattern, as well as what they are looking for in chart pattern.

- Chart patterns are collective human behavior. Human behavior in the market creates some patterns type on the charts. Chart pattern trading is really about understanding the psychological human behavior of the market using those patterns.

- Price patterns form the structure of the market. You can’t predict with 100% accuracy where the market will go next but Price patterns. Chart Patterns Can help reduce uncertainty and show you the probable next move of the market.

Types of Chart Patterns in Trading

The changes in trend usually require a period of transition. The problem is that these periods of transition do not always signal a trend reversal. Sometimes these transition periods just indicate a pause or consolidation in the existing trend after which the original trend is resumed.

Chart patterns are divided into three types: continuation patterns, reversal patterns, and bilateral patterns.

- A continuation chart pattern signals that an ongoing trend will continue

- Reversal price patterns signal that a trend may be about to change direction

- Bilateral chart patterns signal that the price could move either way meaning the market is highly volatile

Best Chart Patterns in Trading

Here are 7 chart patterns every trader needs to know.

- Head and shoulders

- Double top and Double bottom

- Rounding bottom

- Cup and handle

- Wedges

- Pennant or flags

- Ascending Triangle and Descending triangle and Symmetrical triangle

Elements of Price Pattern

- Trend and bias

- Pattern Description:

- Price action characteristics

- Logic

- Time

- Supply and demand (volume)relation

- Entry

- Stop loss

- Target

LET’S discuss all the above points in detail in each chart pattern

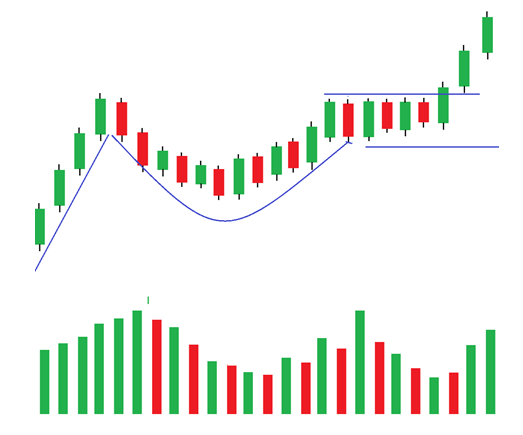

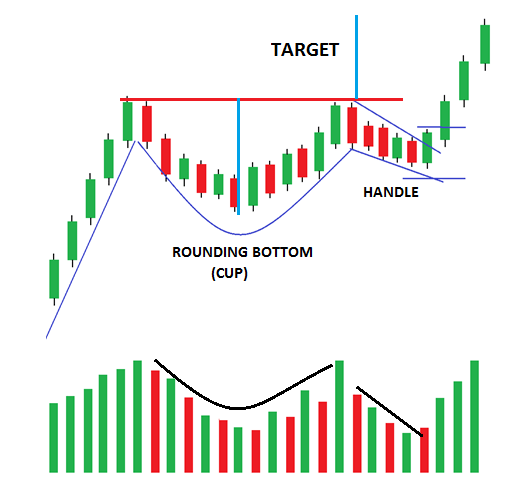

Cup and Handle Chart Pattern

- Directional Bias: Bullish

- Pattern Type: Continuation pattern

- Price Action Characteristics: This pattern occurs within the context of an uptrend. the price forming a u-shaped cup (rounding bottom) with a short handle on the right like a flag pattern

- Logic: The last retracement (handle) is the last bearish move. When the price falls, we expect the market to rise. Like bullish flag pattern

- Volume behavior: Volume will typically follow the shape of the cup (or rounding boom), with high volume as the left lip forms, falling volume as the bottom of the cup forms, and rising volume toward the right lip, and again volume decrease on last bearish push

- Entry: The conservative entry for the Cup & Handle chart pattern is to buy on break-out of the high of the cup. The aggressive entry can take place once the handle breakout.

- Breakout Confirmation: A strong candle close above the upper trend-line drawn across the handle with above-average volume

- Target /Measuring Technique: The price target is obtained by measuring the start of the cup to the bottom of the cup and then added to the price level of the cup

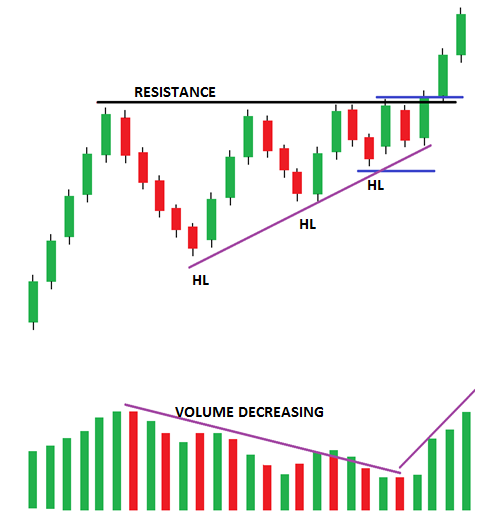

Ascending Triangle Chart Pattern

- Directional Bias: Bullish

- Pattern Type: Continuation

- Price Action Characteristics: This pattern occurs within an uptrend and consists of equal highs and rising lows forming a triangle

- Logic: There was a relatively strong horizontal upper resistance line that was holding the price from going higher. Each time price hits the resistance line, it drops. However, each time it drops, the fall weakens. Thus, it starts making higher lows. From a smart money psychology point of view, this seems to suggest that there was a large sell order placed at a fixed price (where horizontal upper resistance line is located). Each time the buyers pushing the price to that level, the price is rejected from the resistance line and drops as part of the order got triggered. This process continues for a while until the entire order was cleared from the resistance line and once there weren’t any more sellers, the price was pushed higher by strong buyers

- Volume behavior: The volume declines throughout the triangle formation

- Entry: In a bull trend, buy on break-out above an Ascending Triangle

- Breakout Confirmation: The confirmation for this pattern is a strong candle close above the highs on above-average volume.

- Measuring Technique: Subtract the height of the highs of the pattern and lowest low of the pattern and then add this amount to the breakout level.

The remaining pattern will be discussed in our next article. Please watch the following video if you want to learn and understand this concept in a better way.

Tiada ulasan:

Catat Ulasan