Opening Range Trading Strategy

In this article, I am going to discuss the Opening Range Trading Strategy in detail. Please read our previous article where we discussed VWAP Trading with examples. At the end of this article, you will understand the following pointers in detail.

- Understanding market sentiment

- Understanding opening range

- Opening range comparative analysis

- Opening range trading strategy

UNDERSTANDING MARKET SENTIMENT

- Different market sentiment is like related to the prospects of a specific company. There is also sentiment based on the company’s industry group, and there is sentiment regarding the condition of the whole market(corona effect)

- The force behind any price move is market’s mood or sentiment. Not news or earning, there are already happen. I mean old.in good news price fall why?

- Sentiment represents bullish or bearish feelings for the future prospects of a stock. This means the current movements of a stock’s price are dictated by what the market expects will happen in the future, not what has already taken place. Any news is old; any reported earnings data is old information.

How to find out market sentiment in chart?

- Through Principle of Opening Range (OR) trading approach

- You should look at a stock’s price action and volume. And find out what it demonstrates that its sentiment is bullish, bearish or undecided?

Opening price

The Opening Price is the first trade of the day. Balance point of current day. Daily open price act as support and resistance.

The Importance rules

- Don’t try to buy below the open on expected up close days.

- Don’t try to sell above the opening on expected large down days.

What we study at opening?

- Where price open relative to previous day high and low

- Where the next support or resistance level ?

OPENING CANDLE in Opening Range Trading Strategy

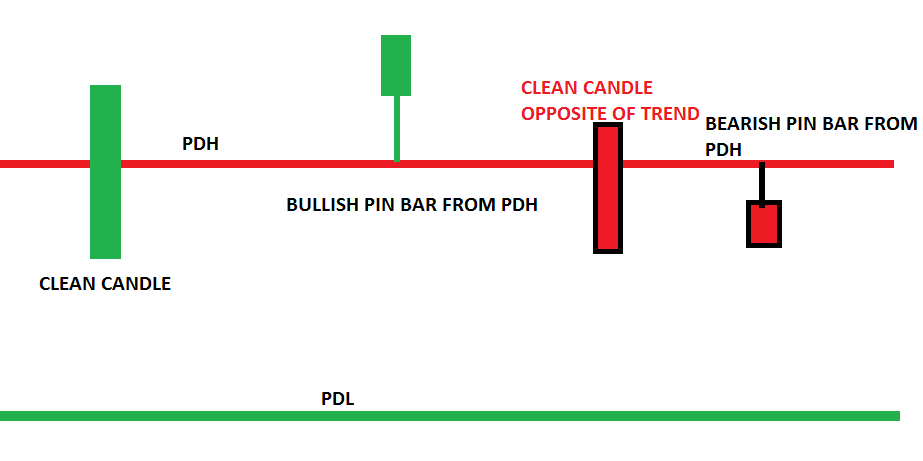

OPENING CANDLE SUGGEST THE SENTIMENT FOR THE DAY. IF FORMED AT KEY SR LEVEL(PDL/PDH/LSL/LSH)

- Clean ,Strong wide range candle with volume indicate strong market sentiment

- PIN BAR FROM PDH/PDL also suggest strong sentiment

The proper knowledge of opening candle and the price action around a reference point very crucial for successful trades. Follow the trend

Initial move

Two types of player

- Smart money

- Retailer

Market always looks to handle the current business first. So the initial move will usually tell us about,

- Who were the trapped traders from yesterday scampering for an exit today?

- Who missed an entry yesterday and are rushing into the morning markets?

- Who is driving the price?

once the current business is taken care of, we can then start looking for the serious traders trying to give market a direction.

How to know above point?

By analyzing direction of move and volume and where price is?

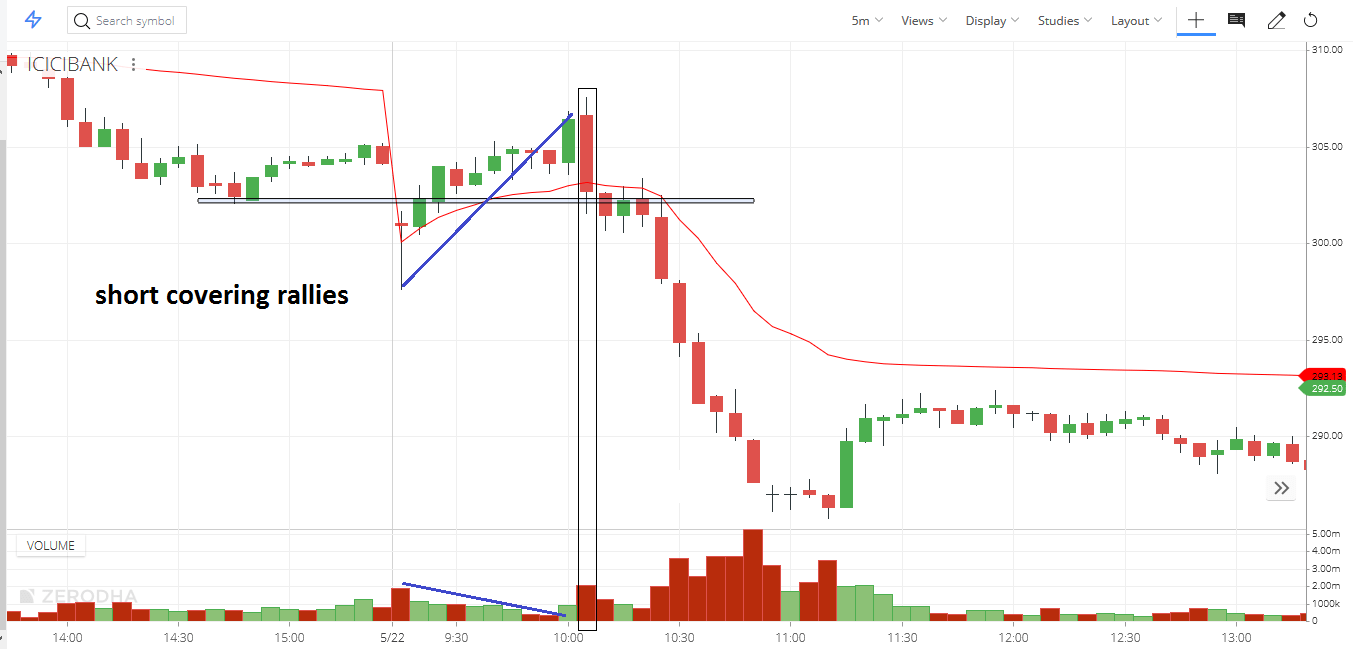

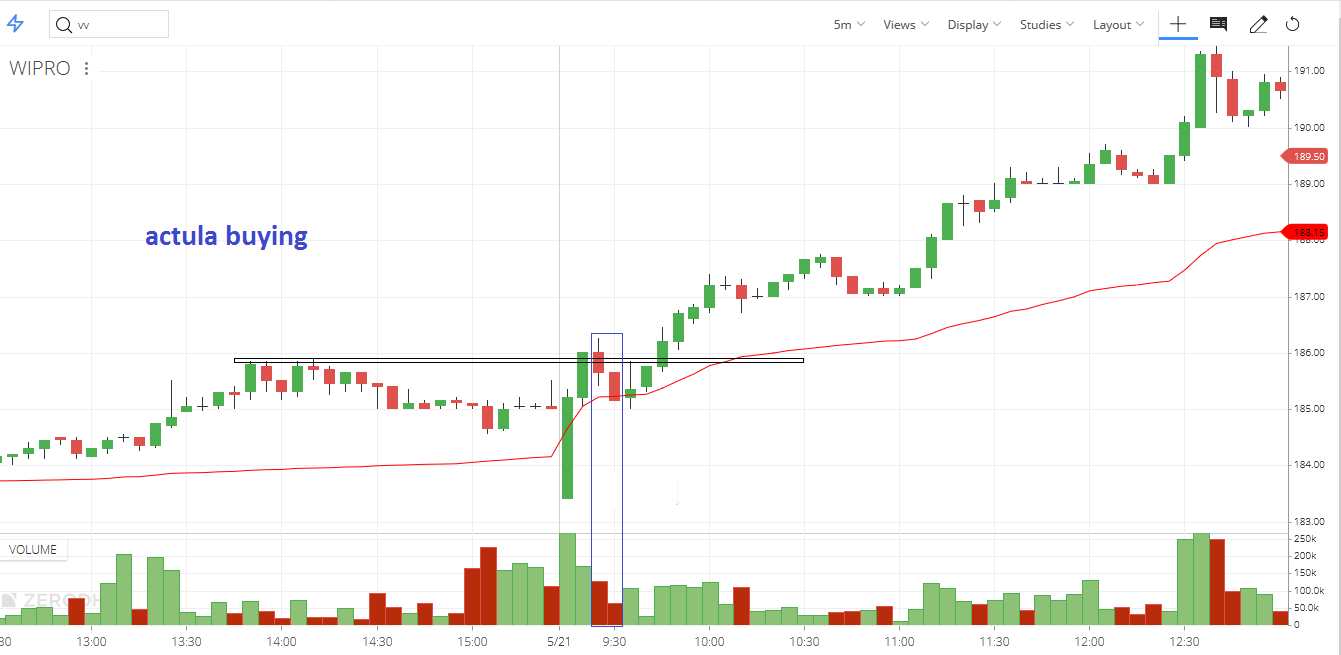

Lets analyse an initial up move

- short covering rallies(discussed in volume price action analysis video

- Actually buying up move

- Morning trap

Why should avoid initial move for entry (morning rap)

The “Morning Specials” is composed with two scenarios which can trap novice traders to believe market is moving in one direction, but in fact, reversal is just around the corner.

- Often you see price is moving in one direction very strongly from the opening bell. The momentum is so strong, it creates a parabolic curve. It makes you regret not entering early. But don’t get trapped, this parabolic move often get reversed. The psychology behind this is that trend is healthy when it’s made of average trend bars closing near the extremes, consecutiveness and small corrections. But when the momentum gets out of control, such as a parabolic curve with gigantic bars without pullbacks, control has to be restored. Too fast too big is a problem because there is no consistency. Market is balanced, where both bulls and bears can profit. If price is only favoring one side, resistance will be met. Keep this in mind when you see volatile movement in the early morning. When you see clear signs of failure or exhaustion, counter it.

- Operator will run the price down fast from opening and or below any reference point this action creates interest among the traders and brings in selling .Smart money objective are

- To test the selling power of public also who long now wind and exit

- The stock of which in turn is demand by the operator and gives him a chance to buy a little long stock and put out some long orders.

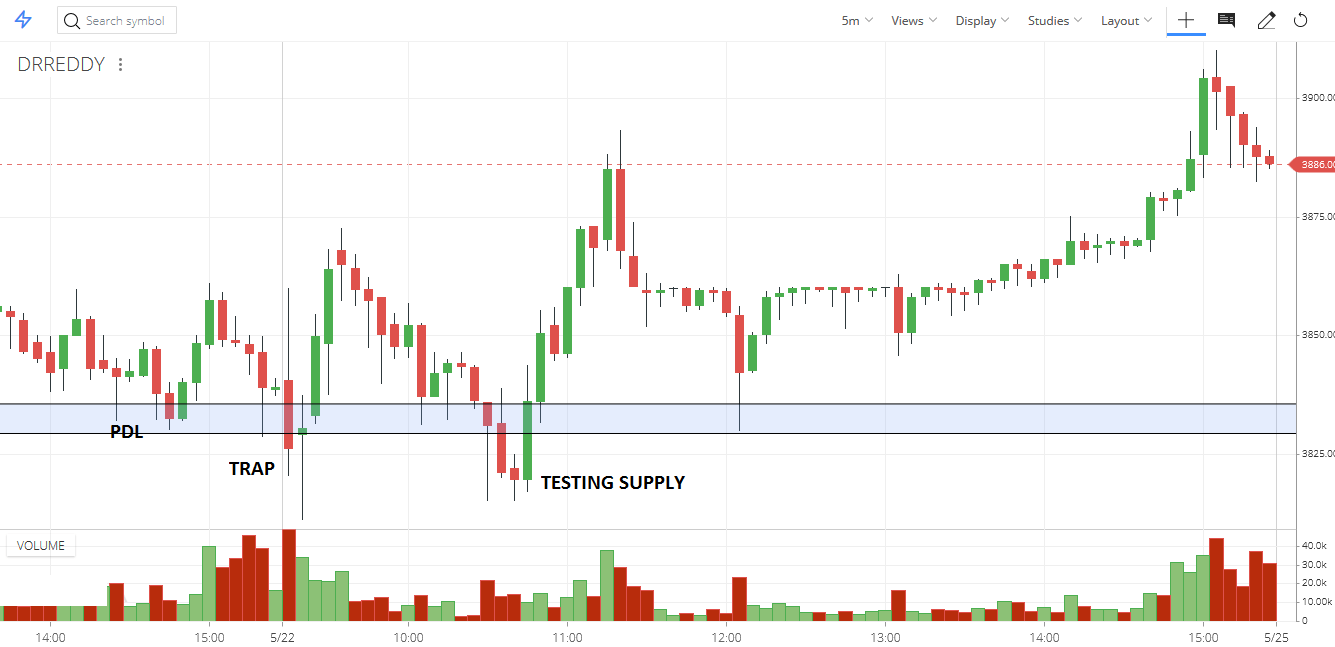

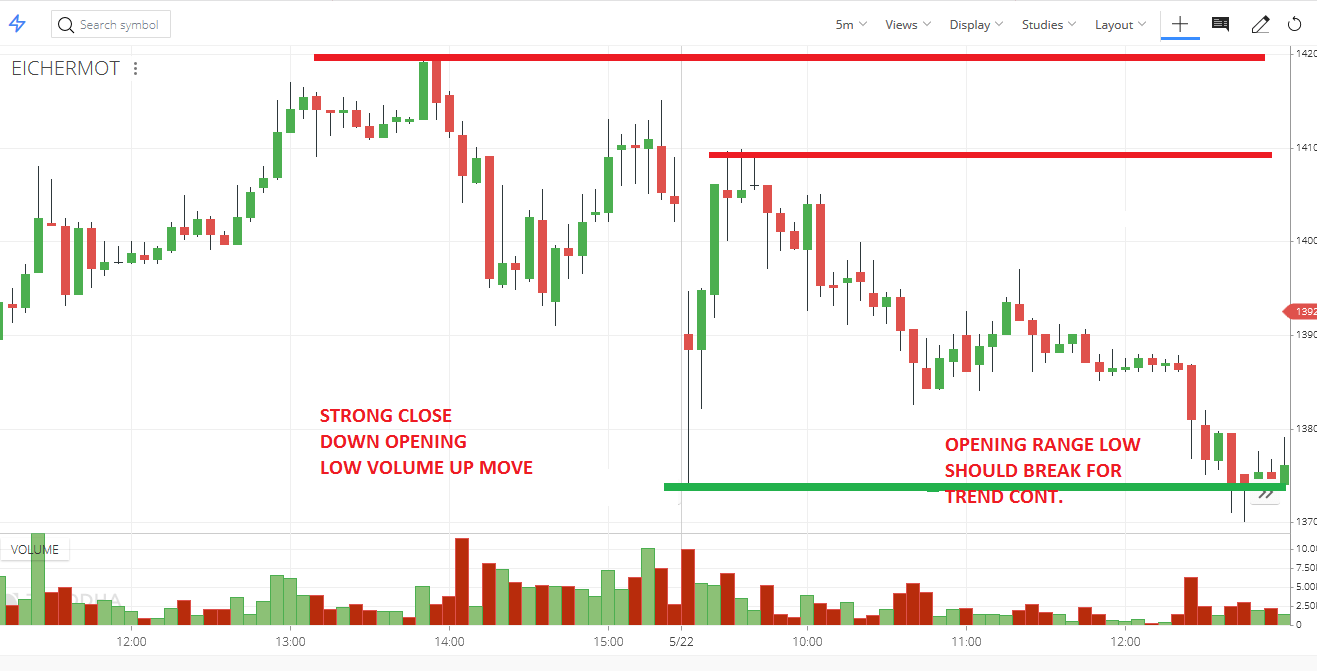

Initial indication of trend change

- Down opening from strong close or up opening from week close indicate may be the beginning of the change of the trend either way(or type 2)

- When the pullback is deeper and stronger than expected, let it roll over. Wait for test

- Low volume move

Opening Range(OR) and initial range(IR)

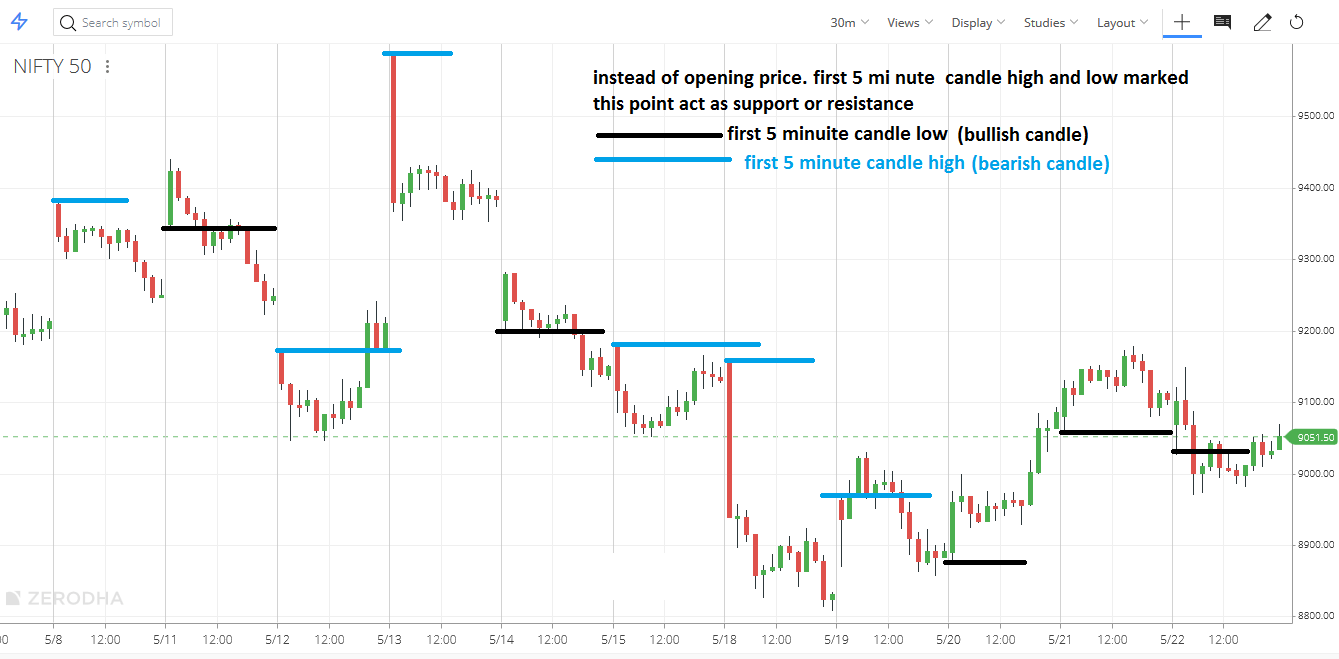

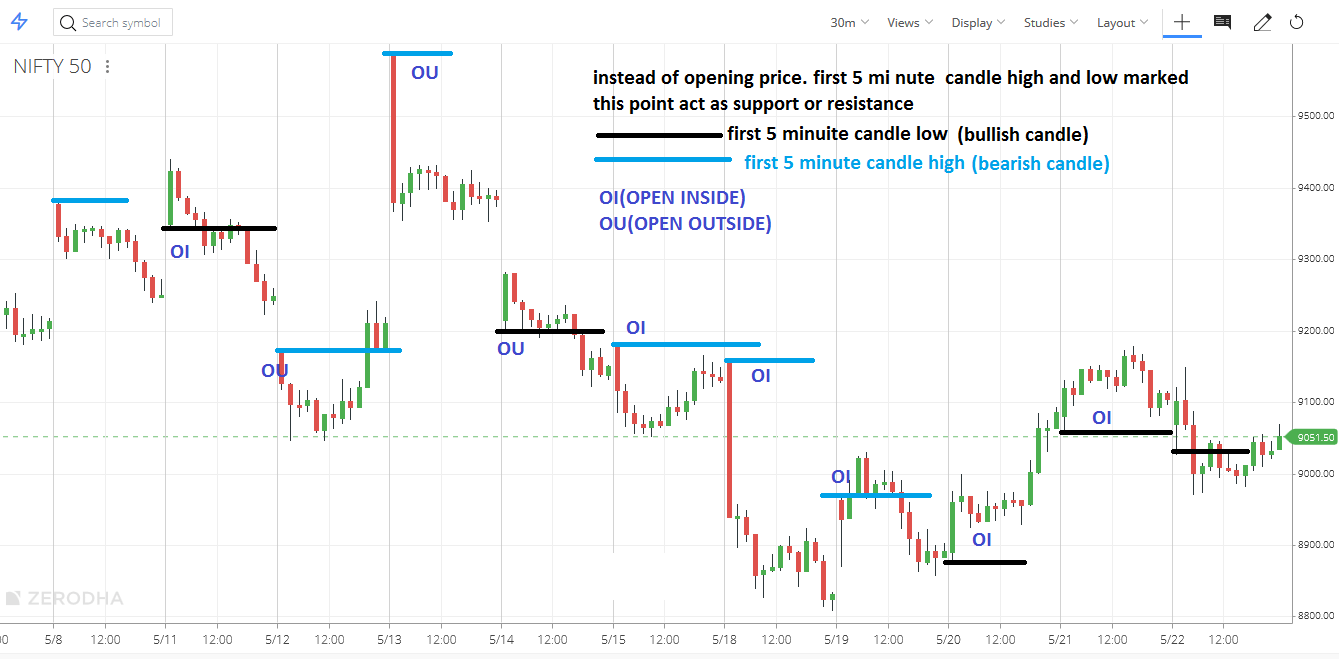

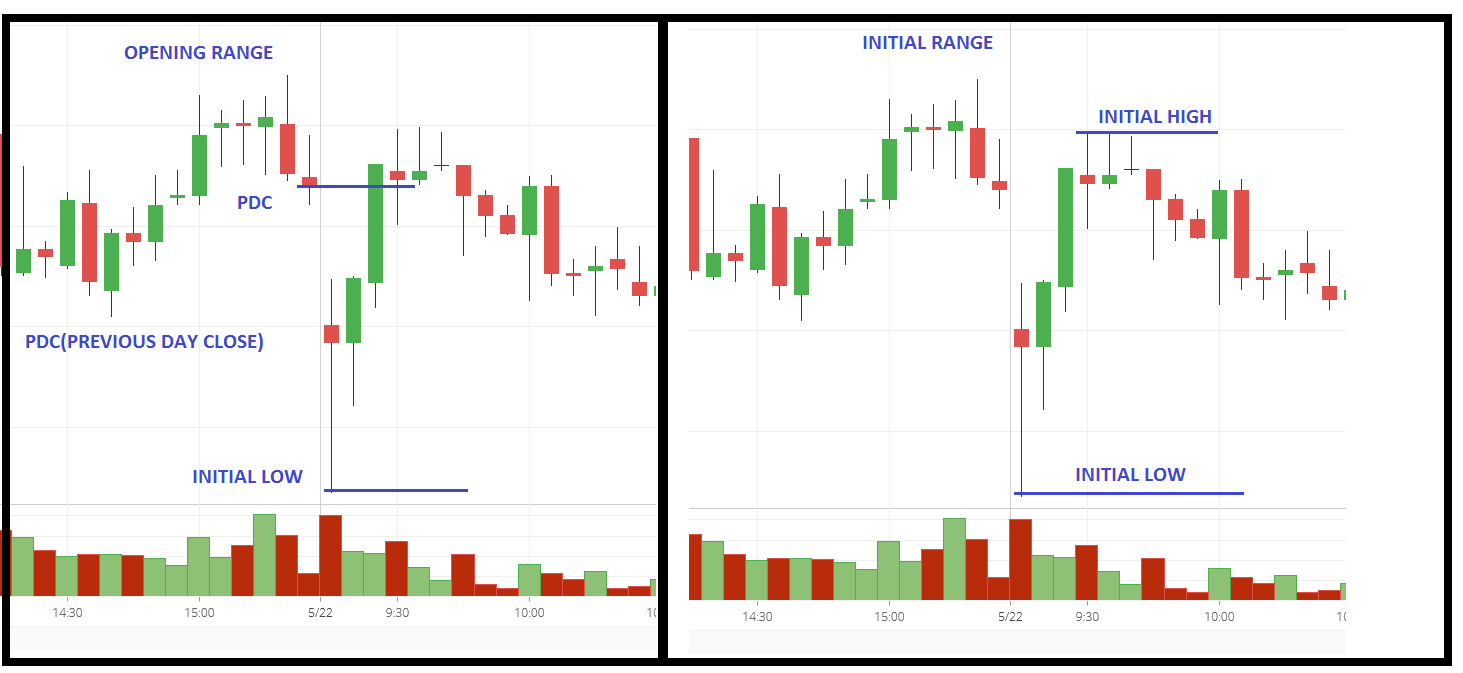

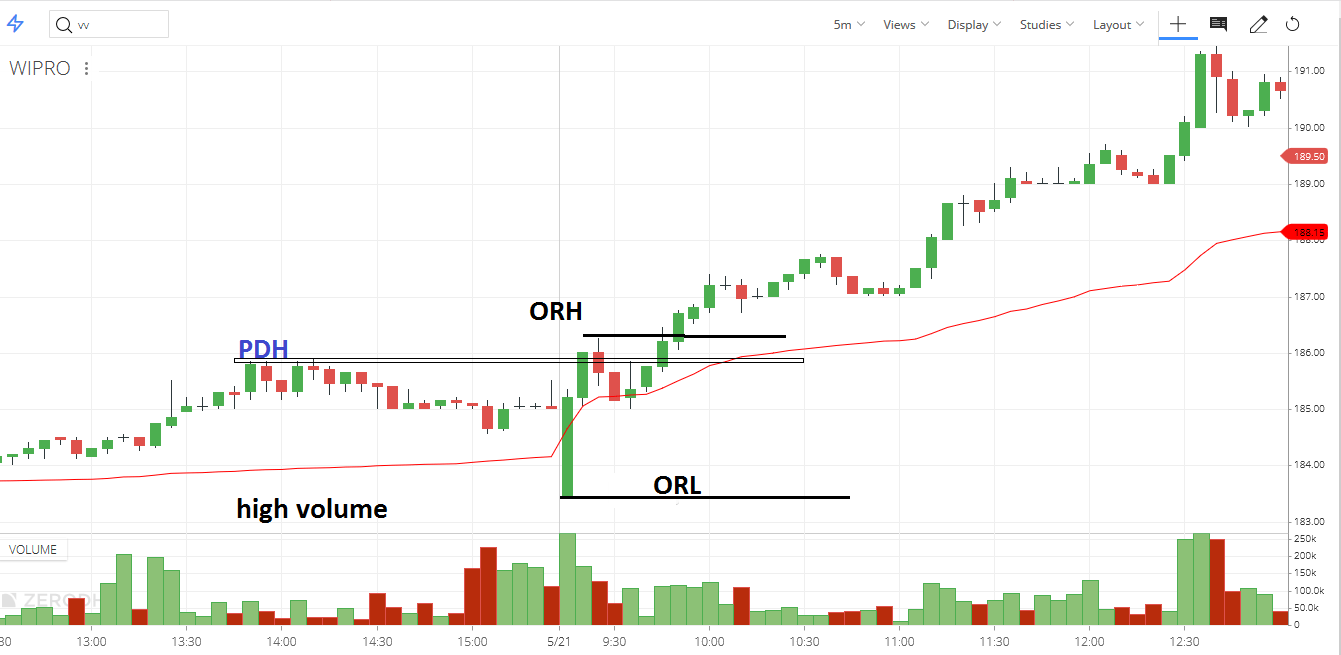

Opening range is defined as the difference between the previous day close to today high or low ,as shown in left side of image

Initial range defines as the difference between the firs high and low of the day. So assume opening range and initial range has same meaning. So next onward opening range means initial range

Why you should study Opening Range?

- Stocks at opening usually experience violent price action that arises from heavy buy and sell orders that come into the market. This heavy trading in the first five minutes is the result of the profit or loss taking of the overnight position holders as well as new investors and traders

- Wise traders sit on their hands and watch for the opening ranges to develop and allow the other traders to fight against each other until one side wins.

- Then develop a trade plan in the direction of the opening range breakout

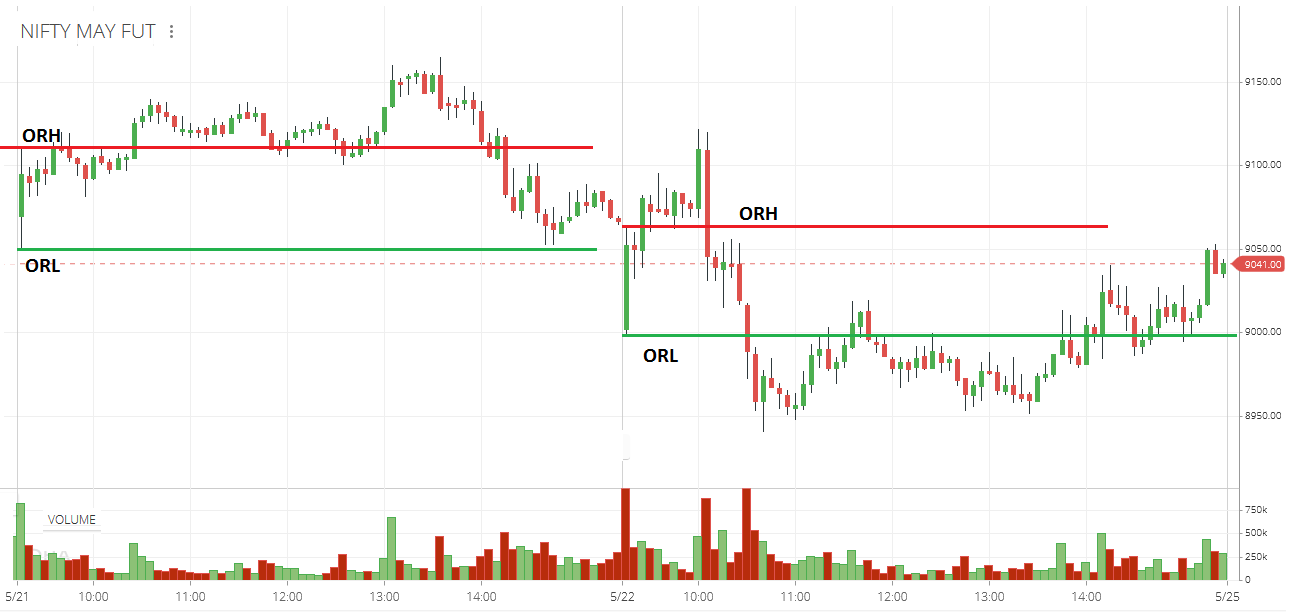

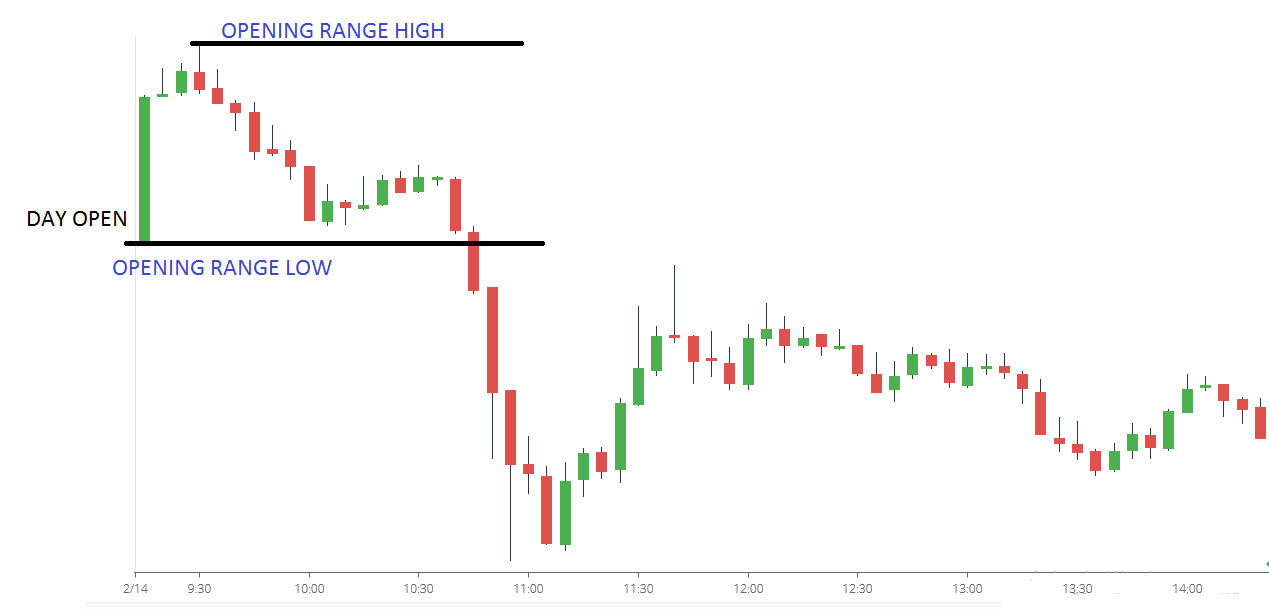

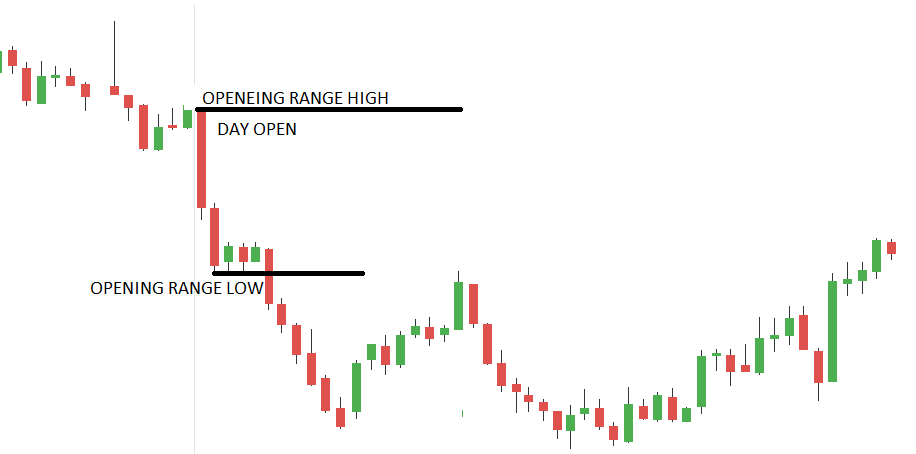

What is the Opening Range (OR)?

- The Opening Range Trading Strategy is consisting of price and volume as inputs to determining the current bias ( bullish, bearish or neutral of the stock’s trading activity)

- The Opening Range Trading Strategy is the difference between the first high and low of the day.

- How to find high and low? At least one candle should be completely against the trend. If that candle has low volume it suggests more strength on trend cont.

Depend open the Opening Range, we can predict what types of day may occur

There are various types of day pattern, but generally these four types day pattern are occur again and again

- Trend Day

- Double-Distribution Trend Day

- Typical Day

- Trading Range Day

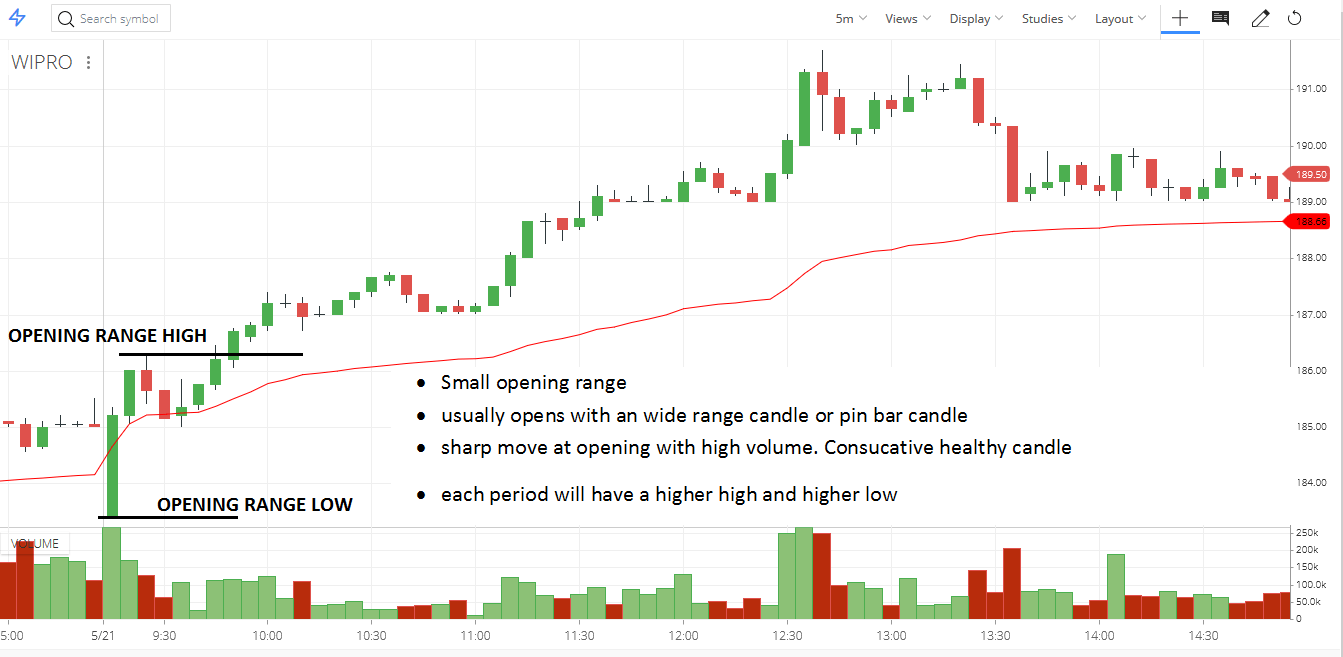

Trend day

- Small opening range

- usually opens with an wide range candle or pin bar candle

- sharp move at opening with high volume. Consucative healthy candle

- each period will have a higher high and higher low

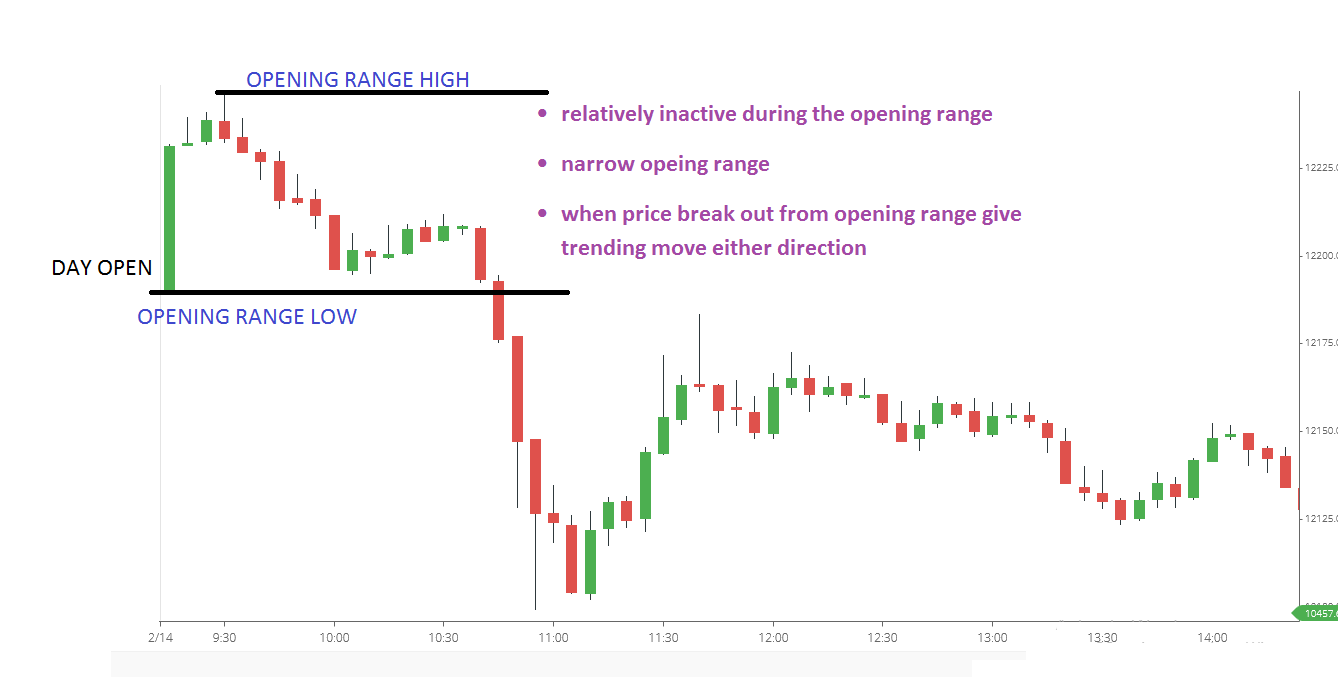

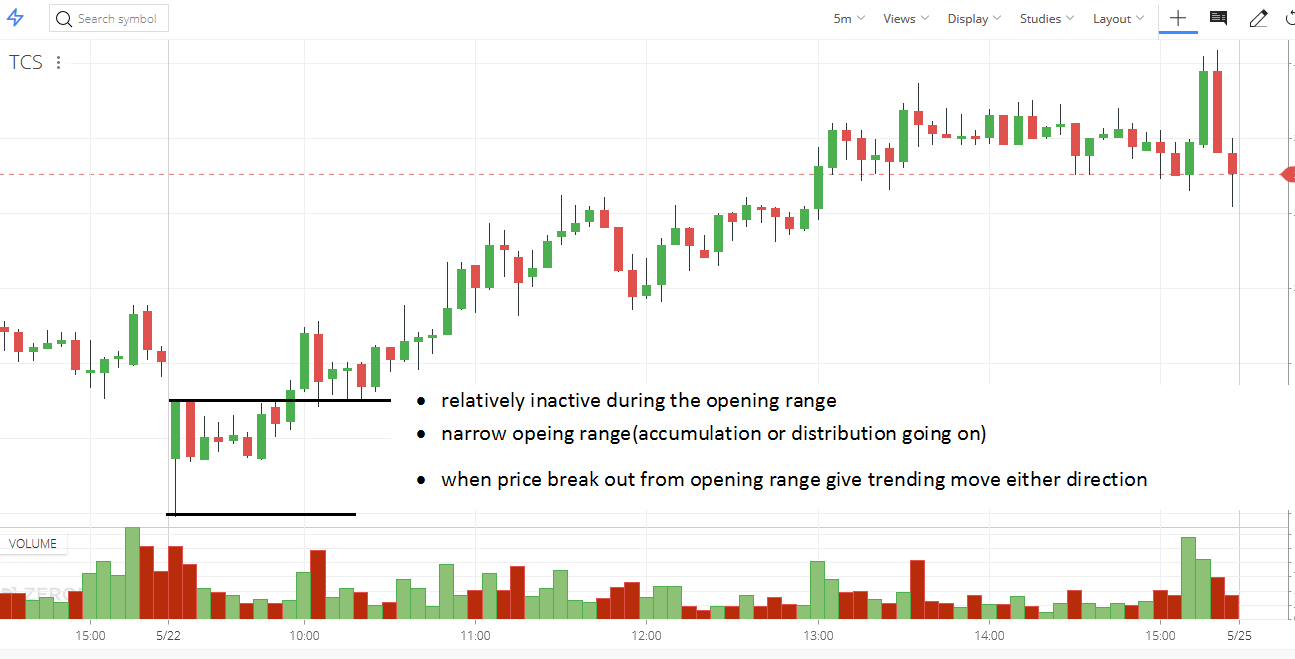

Double distribution trend day

- relatively inactive during the opening range

- narrow opening range(accumulation or distribution going on)

- when price break out from opening range give trending move either direction

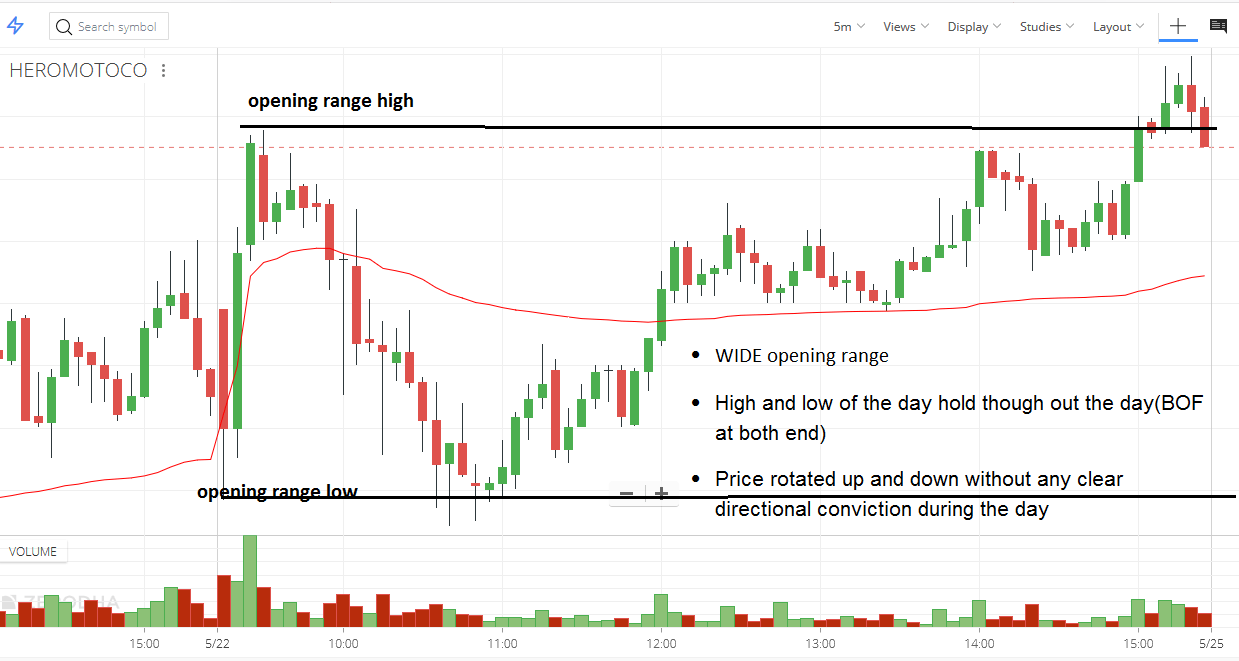

RANGE DAY

- WIDE opening range

- High and low of the day hold though out the day(BOF at both end)

- Price rotated up and down without any clear directional conviction during the day

Typical day

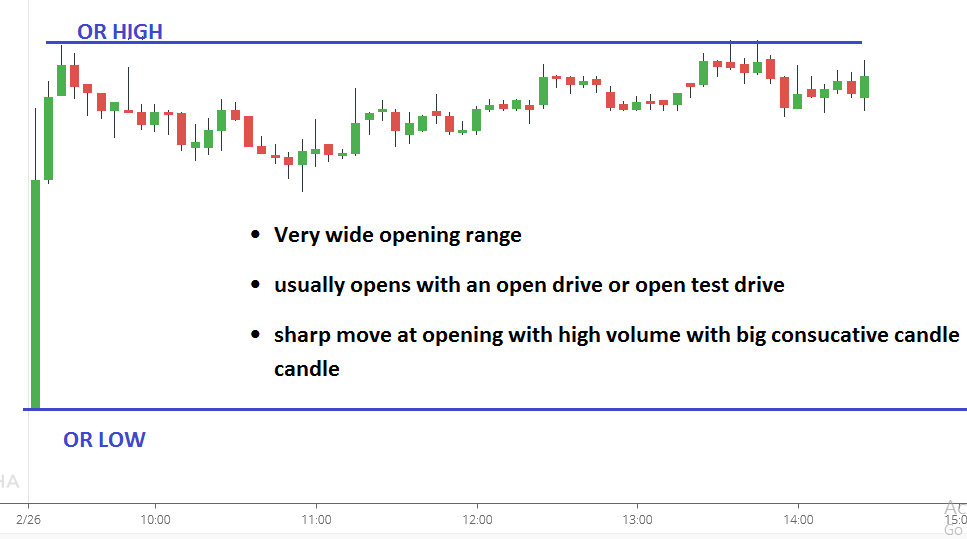

- Very wide opening range

- usually opens with an open drive or open test drive

- sharp move at opening with high volume with very big candle candle

- price generally trading around either day high or day low

How to analyse Opening Range

We will ask five questions for analyzing opening range .The answers to these questions will give your insight into the stock’s current condition.

These are explain below

BIG PICTURE

- What price did yesterday ?

- What types of day?

Where it occur with respect to previous day range?

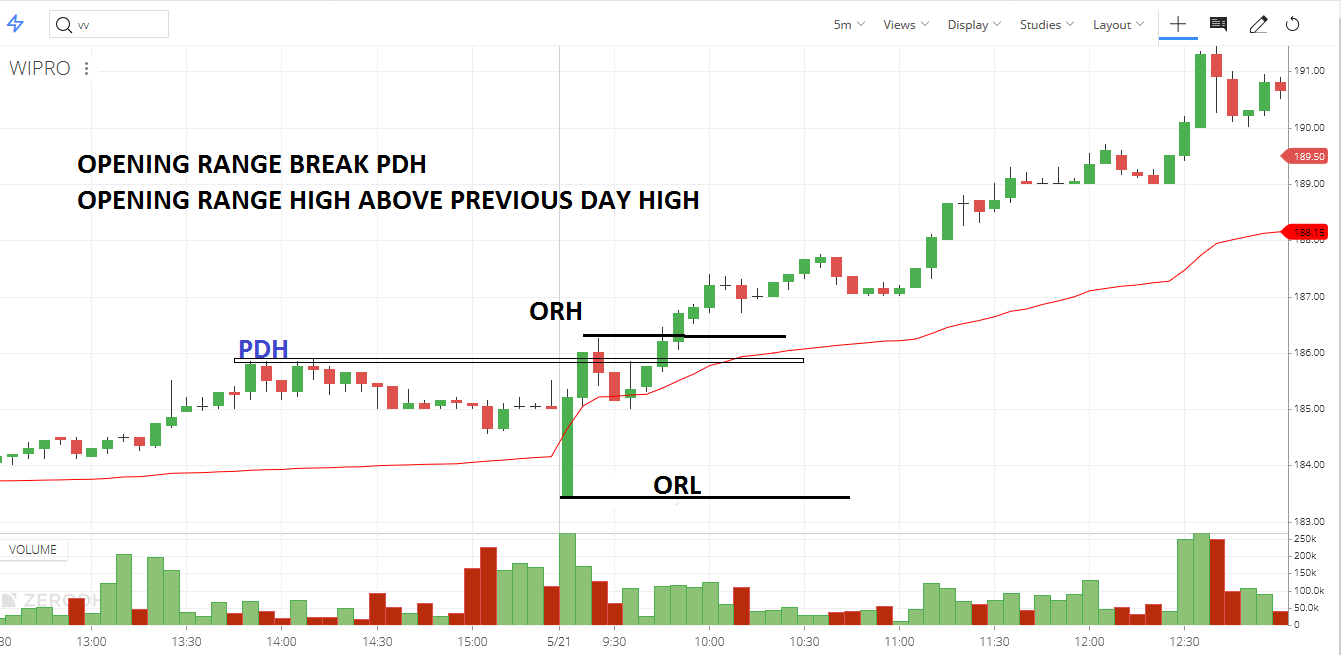

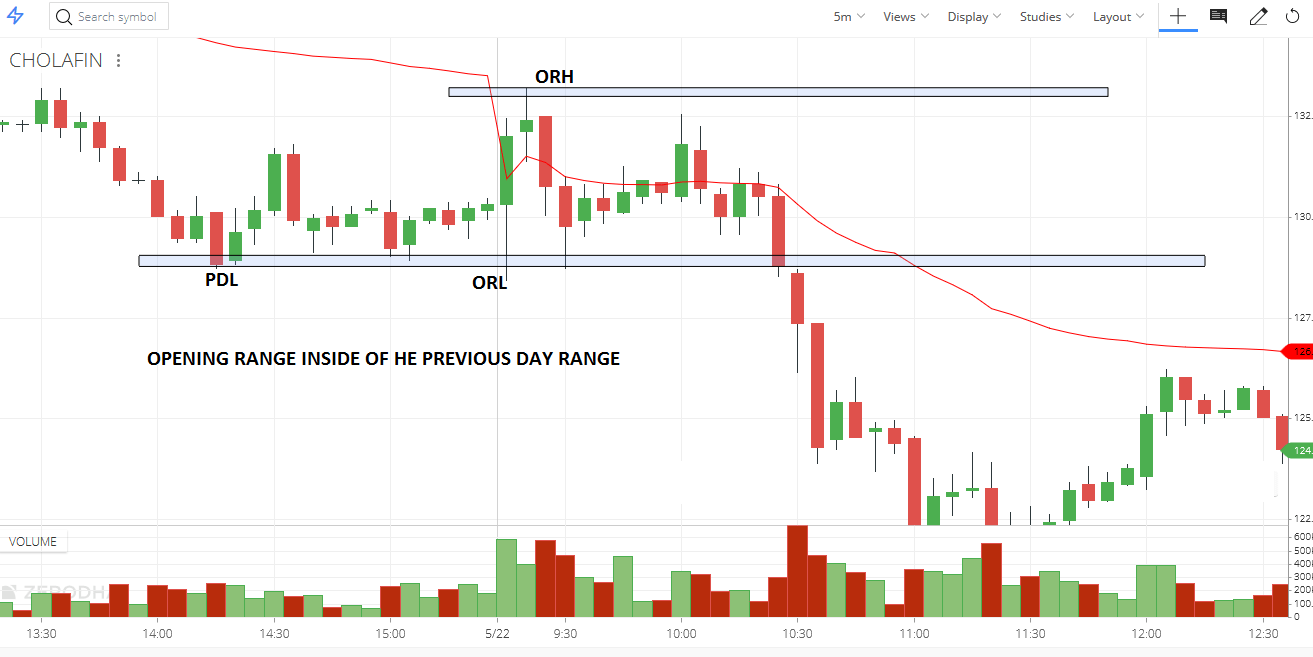

- Inside or outside of previous day range. Identify the opening range and see where the opening range stands, above or below the previous day range (PDR)

- Is market structure change

- Identify the opening range and see whether the opening range low at support or opening range high at resistance.

- Why is it important to establish whether or not the low (high) represents significant support (resistance)? When you are trading using the OR you will approach each day assuming that the OR high and low are likely to be important price levels

- If you knew that a particular price level was likely to be either the high for the day or a significant breakout point, wouldn’t you want to focus on that stock and that price level? You don’t need to know anything about the OR to understand that.

- Where was the last SR crack, on upside or downside, successful crack or failure

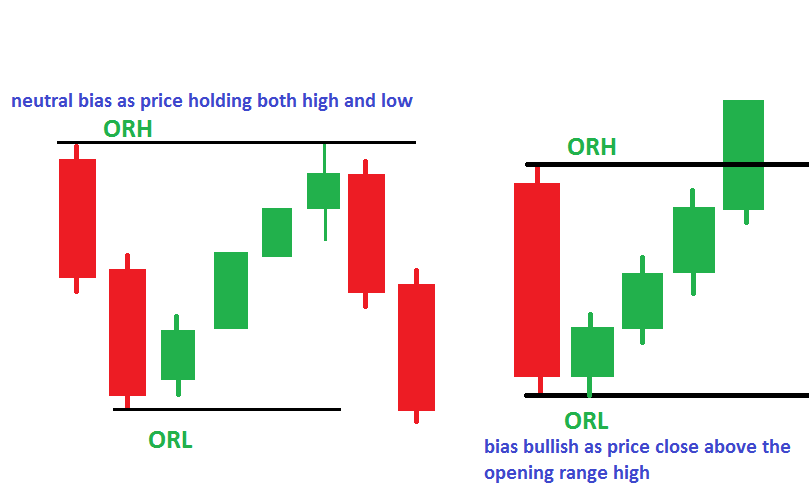

Bias of the day(bullish ,bearish,neutral)

- Opening range represents the bulls and bears establishing their initial positions for the day.

- The most basic application of the opening range principle is that, when a stock move away from the opening range indicates that one side is stronger than the other. When a stock moves above the opening range the bulls are in control. This means the prevailing sentiment in the stock is bullish. The manner in which the stock breaks above and trades above the opening range will indicate the strength of the bullish sentiment.

- Don’t buy aggressively until this stock heads upward. Those stocks that trade back above the opening price are likely to go even higher. This is because of new bulls entry plus short cover buy order .so after the reaction period market set the tone of the morning trend

- Check bias with trend

#Tips what I am following

- Don’t buy below opening range. buy above opening range

- Don’t sell above opening range , sell below opening range

- This technique does not work all of the time

How to find bias of the day

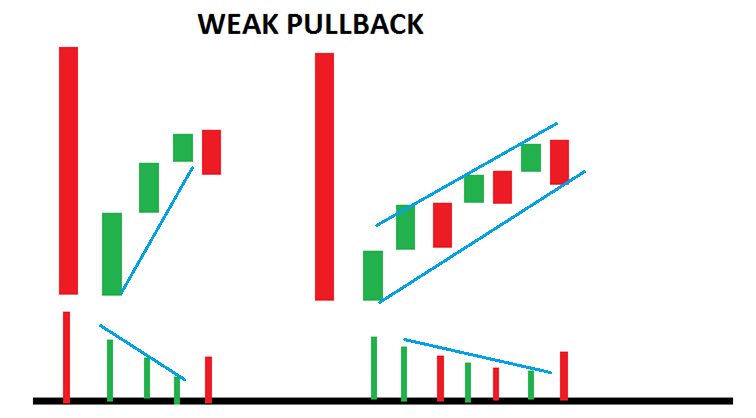

- Identify how much a stock retraces in relative to how much initial move in the opening range. And pay attention to the reaction and how stocks tend to act during this period

- Flat pullback (price consolidate high of the day). Look to see if most of the trading is near one end of the range. Has the stock spent most of its OR period near the highs of the OR? If so, this is bullish Strong buy signal.

- If a stock goes from an up opening and then sells off and remains beneath its opening price after the morning pullback has stabilized, it’s possible that the stock has reached its high of the day.

- however , if a stock gaps up and pulls back during the morning pullback , but then rallies to break above its opening price , the mark-up was probably not trap gap and the stock should make new intraday highs

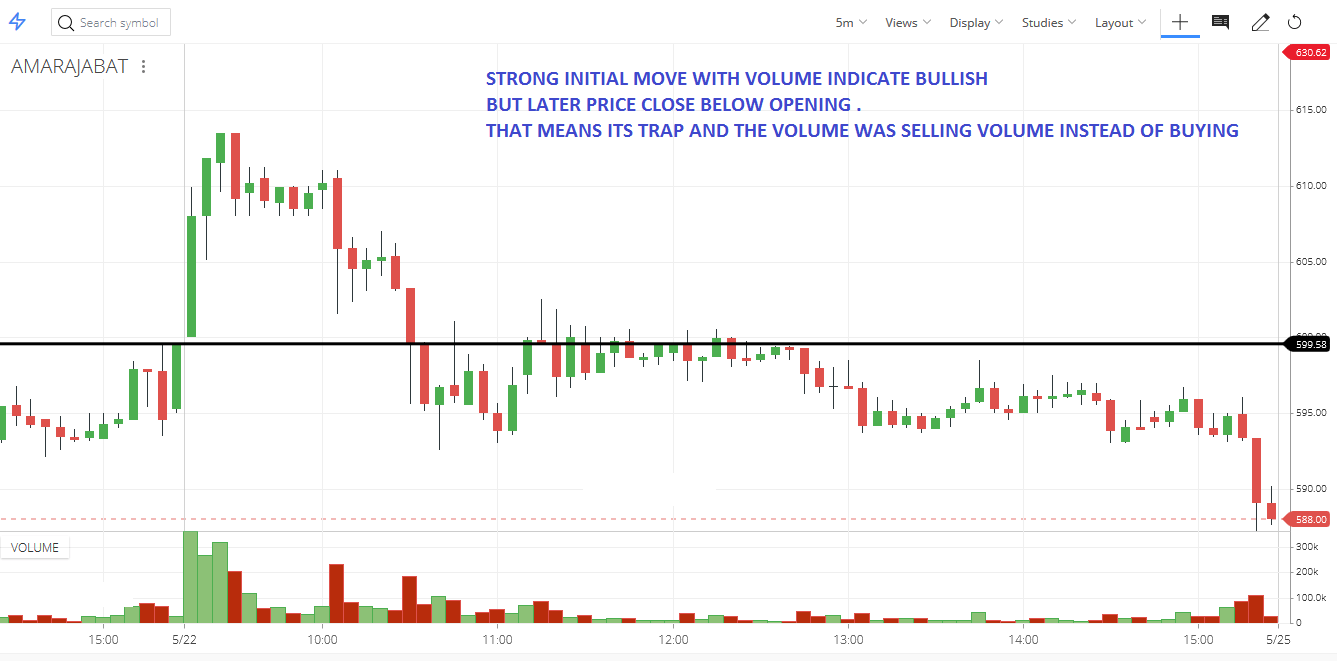

Volume activity for the entire Opening Range?

- Big volume during the OR means there is something unusual going on and that is exactly what you want if you are looking for a big breakout day

Note: Volume it is important to watch the volume carefully, when determining if price will continue with the direction of opening range

- If stock up and the volume also high and also the price remain above its opening price after the early morning pullback, it is an excellent sign that the stock has further to go on the upside.

- If high volume appear after a up move and the stock immediately comes under selling pressure ,chances are that this volume was a seller

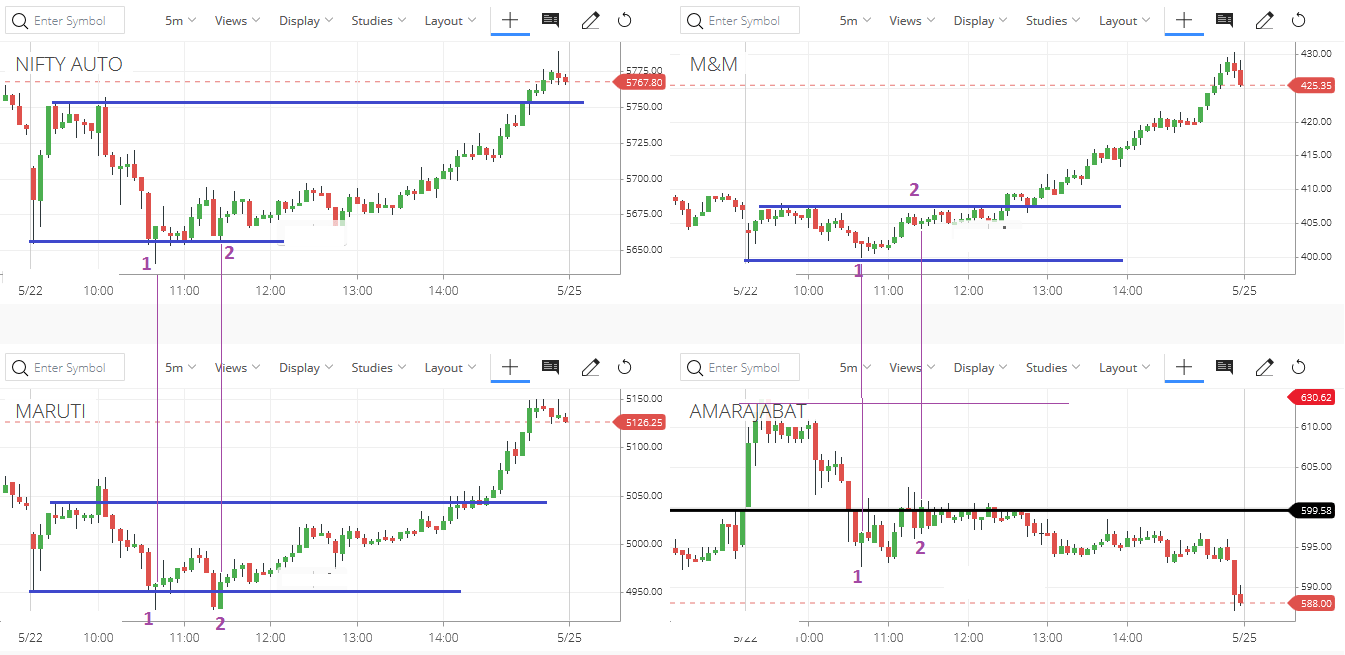

Opening range relative strength with respect to sector and index

Let’s understand with a bullish relative strength with respect to index or sector

When the market takes out it’s OR swing low most stocks will follow suit and take out their respective Opening Range low

Relative to parent index,

- If Stock hold the open or goes sideways when index down. The stocks that do not trade below their OR low are demonstrating bullish intraday relative strength. If the market does not follow through in its breakdown the strong relative strength stocks are the best candidates for an immediate rise in price

- If the Stock up

These are the sign of strength show in the stock relative to index, don’t short these stock , but patiently wait for the index to show some strength or turn from down to up , then go long

1 SECTOR TEST OPENING RANGE LOW

M&M -higher low(indicate bullish)

MARUTI- also test opening range low

AMARAJABAT- break opening range low(bearish)

2 sector making higher low but near opening range low

M&M- stalling at opening range high (bullish)

MARUTI-making lower low (bearish)

AMARAJABAT- price below opening range low(bearish)

Sector is indicating some strength on upside as price struggling to close below opening range low and making higher low .so want bullish stock for long entry

M&M Only showing bullish signal compare to other two stock

The Opening Range Provides Price Points for Identifying Opportunity and Risk

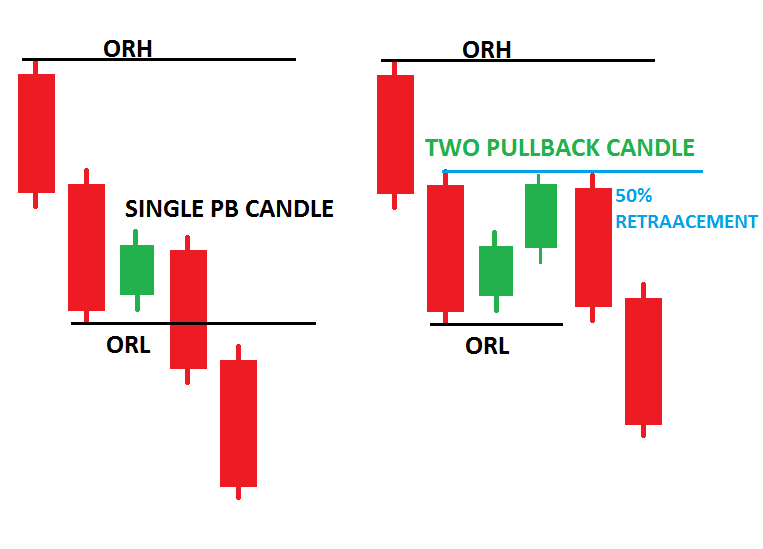

Entry

- Breakout

- Pullback

- Reversal

Please watch the following video if you want to learn and understand Opening Range Trading Strategy concept in a more better way.

Tiada ulasan:

Catat Ulasan