Trendline Trading Strategy in Detail

In this article, I am going to discuss the Trendline Trading Strategy in detail. Before proceeding to this article please read the How to Day Trade with Trend article. As part of this article, I am going to discuss the following pointers in detail which are related to Trendline Trading Strategy.

- The importance of drawing lines over your charts.

- TRENDLINE

- Rules for DRAWING TREND LINES

- How to Determine the Significance of a Trendline Trading Strategy

- The trend channel

- Use of trendlines Trading Strategy

- How to entry based on trend line?

Importance of drawing lines over your charts:

They tell a story. They showing the angle of advance or angle of decline within a price trend, alert when a market has reached an overbought or oversold point within a trend, showing trading ranges, indicate the point of equilibrium (apex), and help forecast where to expect support or resistance on corrections.

Never undertake to draw conclusive deductions from trend lines alone taking care to weigh all of the factors (three) involved in a complete diagnosis of market action. The three factors are Price Movement, Volume, and Price Movement-Volume Relationships determine when and where trend lines may logically be applied} and when it is inadvisable to attempt to apply them

What is the Trendline Trading Strategy?

The momentum of an upward movement is reflected in the angular upward climb of the vertical bars on our charts and the pace of a downward movement by their angular downward pitch. The eye may not always see the pitch of these angular swings clearly because of the confusing effect of minor irregularities of the price movement as recorded on charts. Therefore, it is frequently helpful to employ Trend Lines for this purpose. Thus, the examination of the accompanying charts will show how the angle of ascent or descent of prices may often be visualized more clearly by drawing straight lines through the successive tops or bottoms of the price path established during the minor, intermediate, and major moves

A support or demand Line is that line that identifies the angle of the advance of a bull swing by passing through two successive points of support. Example:- Lines A-C, D-1 in above IMAGE 1

A resistance or Supply Line is that line that identifies the angle of the decline of a bear swing by passing through two successive points of resistance (top of rallies). Example:- Line I-K, and I-6 in above image 2.

An Oversold Position Line is that line that is drawn parallel to a supply or resistance line and passes through the first point of support (reaction low) which intervenes between two successive rally tops in a downtrend. Example:- Line J-L, Note that J is the first point of support intervening between the two successive tops, I and K. IN IMAGE 2

An Overbought Position Line is that line that is drawn parallel to a support line and passes through the first point of resistance (rally top) intervening between two successive points of support in an uptrend. Example: Lines B-E, in above image 1

Rules for Drawing Trendline Trading Strategy

RULES

- DRAW a new trend line by connecting the stat of the trend with a valid swing point.

- Adjust the trend line as price action unfold

DRAW a new trendline by connecting the stat of the trend with a valid swing point

This means that we cannot draw a new trendline without a valid swing. First of all, there must be evidence of a trend. This means that for an up trendline to be drawn there must be at least two reaction lows with the second low higher than the first

HOW TO FIND VALID SWING HIGH AND SWING LOW? Click here

ADJUSTING New trendlines

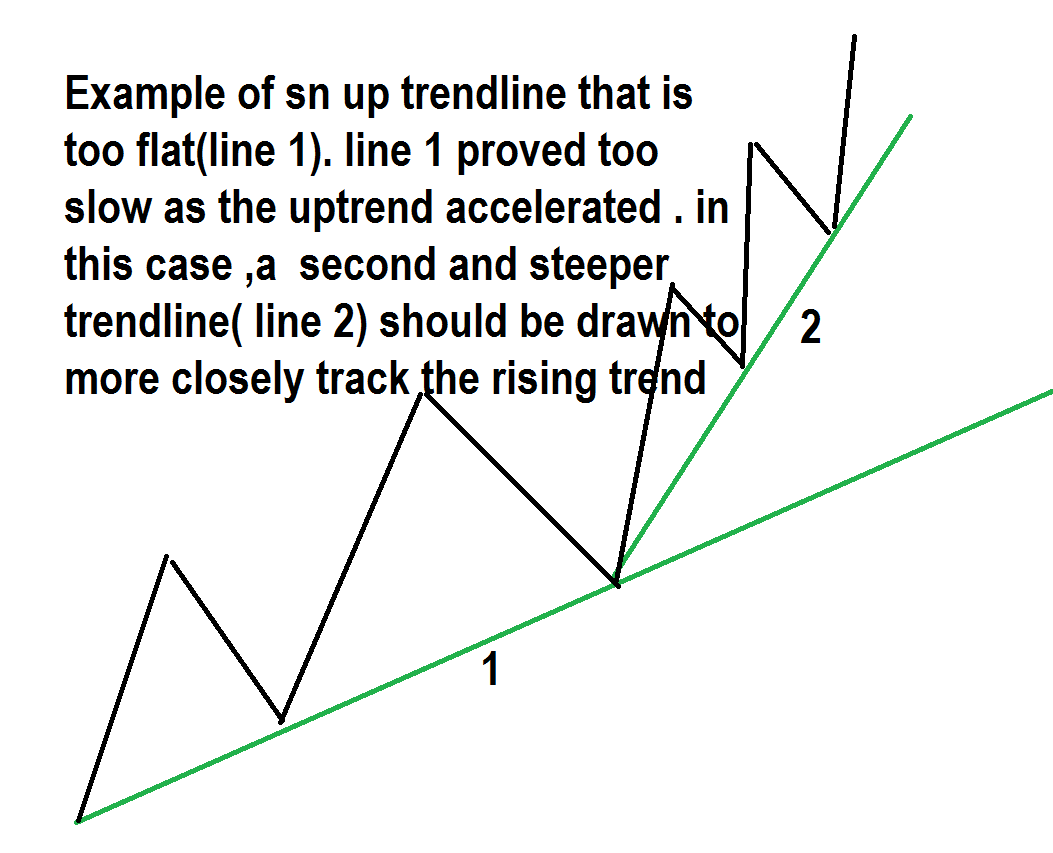

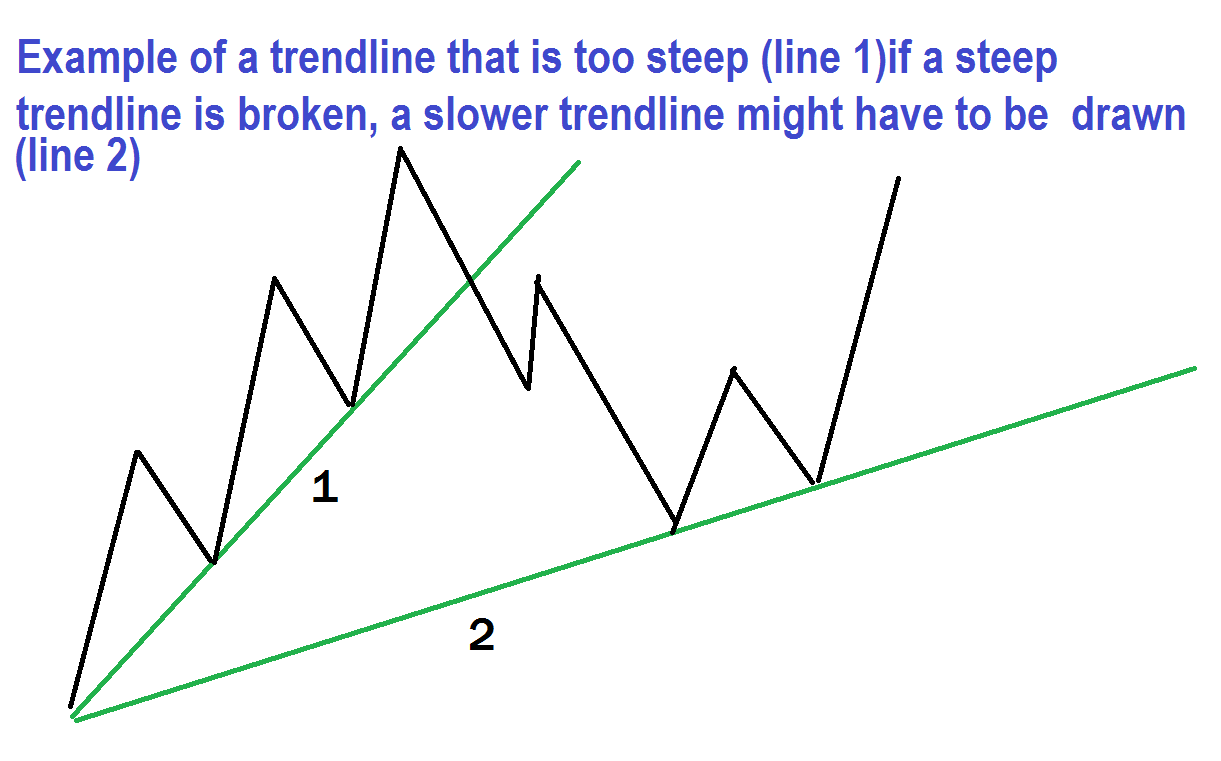

For instance, in the case of an advance, the angle of ascent may be leisurely for a time and then become pitched more sharply upward as the original force of demand is renewed by fresh buying from the sponsors of the move and the public, and perhaps by expanding enthusiasm of bullishly inclined traders and investors. Under these conditions, we have to relocate our trend lines to conform to the newly established stride

If a steep trend line is broken, a slower trend line might have to be drawn

Trendline analysis on a chart

It will be seen that after the reaction to (B), we are able to distinguish two well-defined rally tops, the first at (A) and the second at (C).

Accordingly, if we draw a straight line through the extreme tops of these two rallies we find that the extension of this supply line to the right, across the page, helps to define the approximate limits of subsequent rallies. If, however, it is able to rise through the supply line with some degree of strength by either with increasing volume, or by a material gain in price, or both. Finally price swing E-F successful break the supply line, as both candle and volume increases

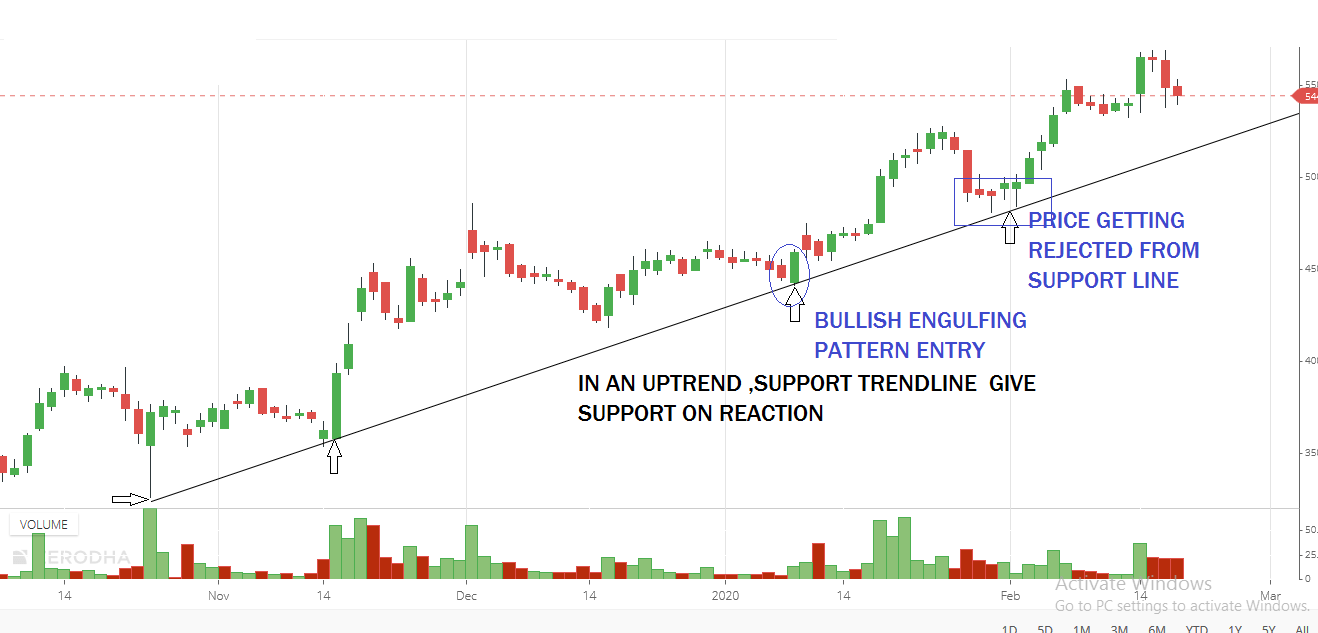

The upswing from G enables us to establish the trend support line E-G which represents the angle, or rate of acceleration, of the first phase of the bull campaign in this stock. Extending this line to the right, we find that after the rise is temporarily accelerated by a sharp run-up from G, then price recedes toward this line of support in what we conclude is a normal corrective reaction. We reason that if it recedes further, we may expect the price to hold on or around this line of support (H). It does hold, for on the quick further rally from G POINT, marked by closing at the high, as the price almost touches our established trend line. Thus our trend line has given us a helpful hint, in advance, as to the point at which we might reasonably look for new demand (support) and the probable place where this particular reaction should end.

After the mark-up from H POINT, we must readjust our trend support line because of the increasing momentum of the rise. PONIT (1) brings a new phase of the advance. This new line, of course, runs from 1-2, price getting support from the support line.

How to Determine the Significance of a Trendline Trading Strategy

- The number of times the trendline has been touched or approached. The larger the number, the greater the significance. A trendline that has been successfully tested five times is obviously a more significant trendline than one that has only been touched three times

- Time factor, a trendline that has been in effect for nine months is of more importance than one that has been in effect for nine weeks or nine days.

- Angel of ascent and descent, a very sharp trend is difficult to maintain and it’s liable to be broken, the steep trend is not more important as that of a more gradual one a large angle on a lower trendline in an uptrend means that the lows are rising significantly fast and that the momentum is high.

THE TREND CHANNEL

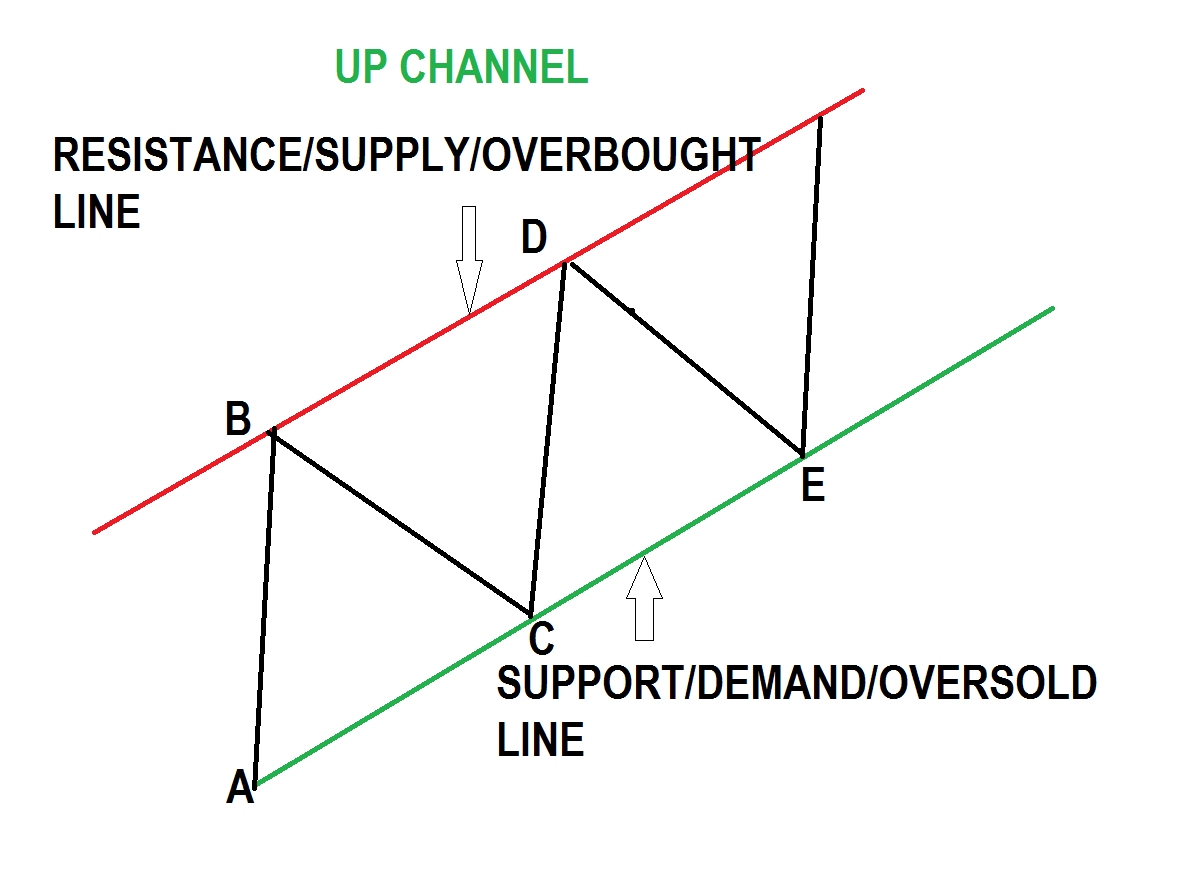

Occasionally, the momentum produced by the forces of demand and supply will become so plainly marked as to develop a well-defined zone of activity; that is, the alternating buying and selling waves form a price path or channel whose upper and lower limits are easily identified by a series of tops and bottoms confined within parallel, or nearly parallel, lines.

The drawing of the channel line is very simple. In an uptrend, first, draw the support or demand line along with the lows (A-C). Then draw a line from the first prominent peak (point B), which is parallel to the support or demand trend line. Both lines move up to the right, forming a channel If the next rally reaches and backs off from the channel line (at point D), then a channel may exist. If prices drop back to the original trendline (at point E), then a channel probably does exist. The same holds true for a downtrend, but of course in the opposite direction

In the uptrend supply line act as overbought, the price will be reverse from the supply line. Support line act as oversold

Use of Trendline in Trading:

Use of trend lines is frequently helpful in judging the points at which you may expect the price:-

- To be supported on reactions;

- To meet resistance on rallies; and

- Overbought and oversold condition sowing in channel

- To approach a critical position in its travel from one level to another. Trend line l also help you to foresee the possibilities of an impending change of trend before it actually takes place

The violation of a trend line often (but by no means always) may signify that the force of demand or supply which was formerly in effect is now becoming exhausted. This may either mean that the price movement is changing its rate of progress, or it may mean that the trend is definitely in danger of being reversed.

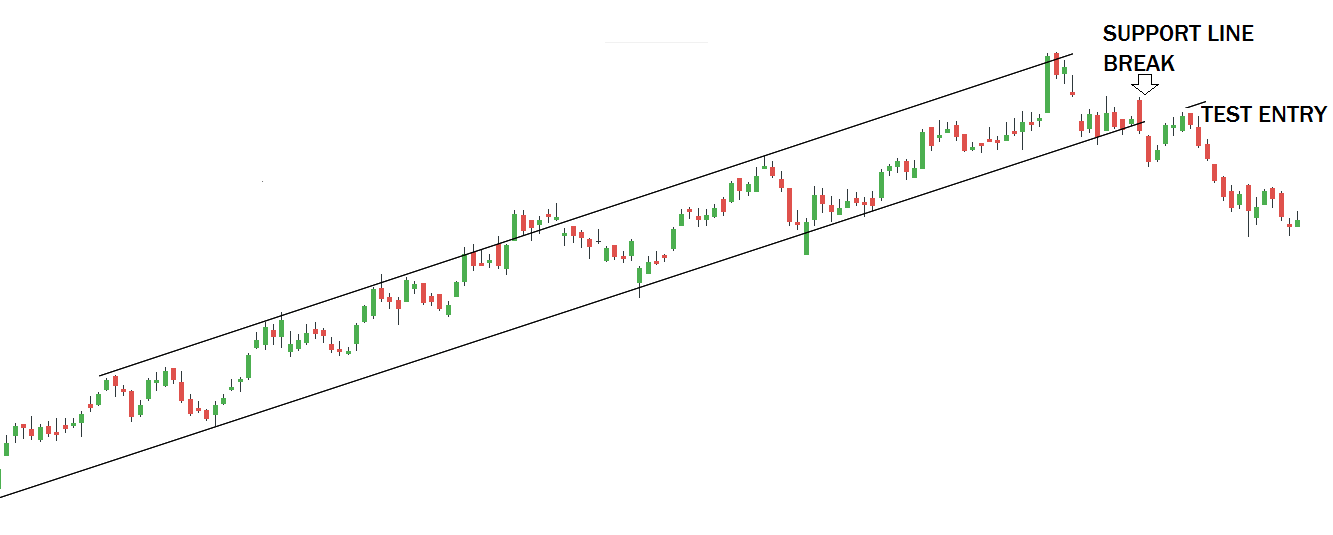

Trendline Trading Strategy

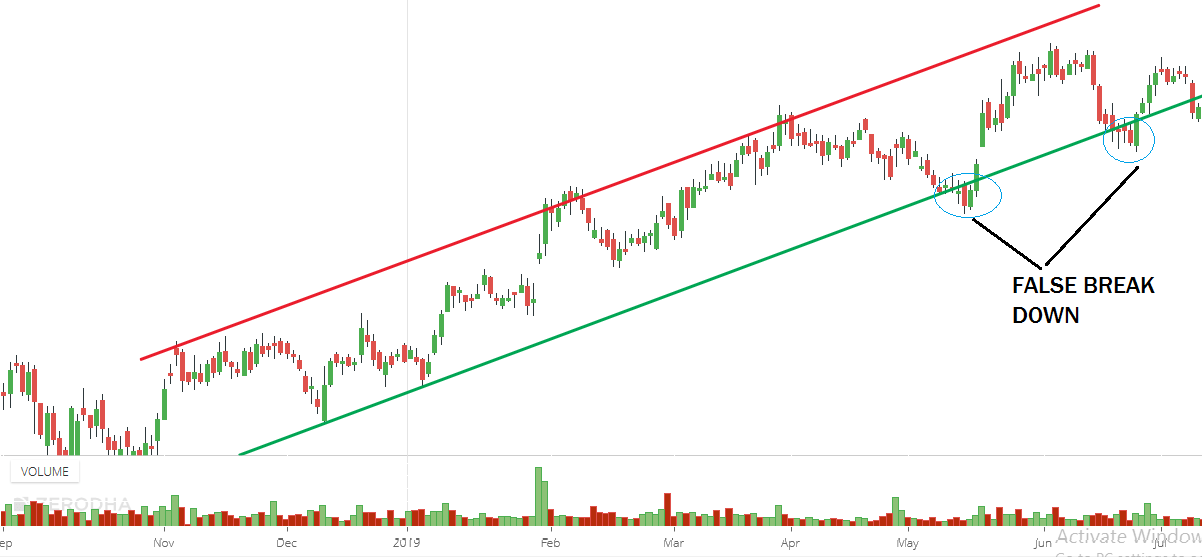

It is bad practice to take entry on a stock simply because it has penetrated an established. Trendline or broken out of an extended congestion area. The significant thing is HOW the line is broken; the conditions under which the change of stride occurs.

The quality of the buying or the selling at and around the point of penetration determines whether the violation of an established trendline may be regarded as evidence of a further price movement in the direction of the breakthrough, or whether it means the only temporary change of false breakout. For breakout, the price needs to close above or below the trendline

An opposite trade to be taken on the retest of the trendline

Tiada ulasan:

Catat Ulasan